Research published today by the Home Builders Federation (HBF) has found that buyers of new build houses in England will save an average of £3,100 in energy bills compared with typical older properties when the Government’s Energy Price Guarantee (EPG) cap increases on 1 April 2023.

The updated ‘Watt a Save!’ report analyses Energy Performance Certificate (EPC) data from the Department of Levelling Up, Housing and Communities (DLUHC) to reveal the potential energy bill cost savings of new build homes versus existing properties.

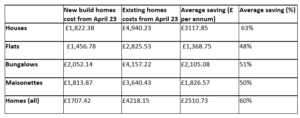

The analysis finds that under the new EPG prices, the annual energy bill of the average new build (flats, maisonettes, bungalows and houses) is likely to be £1,707, saving £2,510 compared to buyers of older properties who will be facing bills of an average of £4,218.

Buyers of houses, rather than flats or bungalows, will see the greatest savings, estimated at £3,118 a year.

The report also finds that:

New build properties require significantly less energy use, at approximately 95 kWh per m2 each year, as compared to older properties which require an average of 252kWh per m2.

85% of new build houses had an A or B (EPC) rating; while less than 4% of existing dwellings reached the same energy efficiency standard.

Average new build properties emit 2.2 tonnes of carbon less than older properties each year, with the newer homes in this dataset reducing overall carbon emissions by over 500,000 tonnes a year.

Alongside the report, research commissioned by HBF has found that consumers are increasingly prioritising energy efficiency when considering a house move, with more than half of respondents to a recent survey (53%) stating that lower utility bills and running costs due to increased energy efficiency would encourage them to buy a new home. Despite this, most mortgage affordability calculations are based on a national average energy bill.

The same consumer survey found that just under 1 in 5 felt the top issue preventing them from buying a house was uncertainty over whether they would be able to secure a mortgage.

HBF is calling on mortgage lenders to accelerate the introduction of genuine ‘green mortgages’ that take into account these savings when assessing applicants such that more people can realise their ambition of home ownership.

The report comes ahead of New Homes Week, 27 February to 3 March, which will showcase the benefits of new build homes and raise awareness of the schemes available to support aspiring homeowners to secure a new property. Further information on New Homes Week can be found on the HBF website.